Grid Edge Innovation: Low Voltage Distribution Visibility for the Energy Transition

A new paradigm is emerging, one that combines real-time visibility, dynamic management, and data-driven decision making to transform how we operate the grid edge.

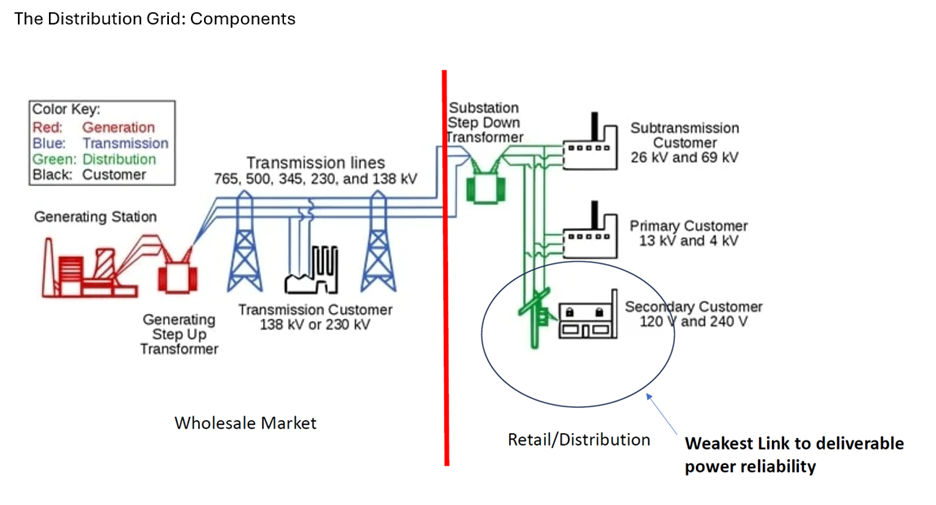

The distribution grid stands at a critical inflection point. As electrification accelerates and distributed energy resources proliferate, utilities are discovering that traditional planning and operational approaches no longer suffice. The distribution grid is miles upon miles of equipment. This article is focusing on the feeders and circuits, and the transformers on them, which provide power to homes and smaller businesses.

The Distribution Challenge: How to Plan and Operate a Dynamic Grid with Static Information?

Traditional models are breaking down under new pressures:

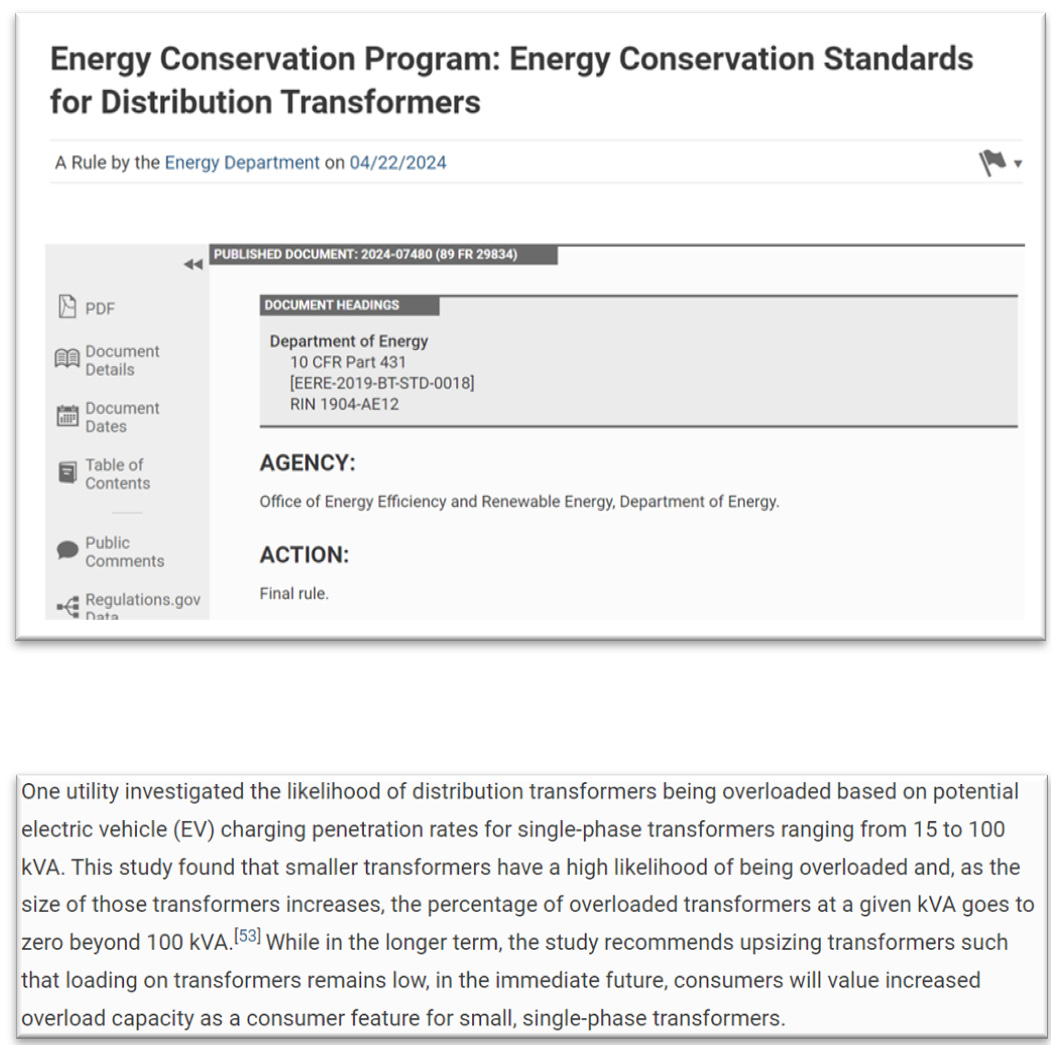

EV adoption is straining smaller transformers but not 24x7, which means 24x7 understanding of utility loading will help create the programs that help electrification and infrastructure health and lifetime management. SMUD’s study, used in the 2024 DOE Final Rule on Energy Conservation Standards for Distribution Transformers, notes that EVs can cause a 100% overload risk for 15 kVA transformer units in high-adoption scenarios.

SMUD investigated the likelihood of distribution transformers being overloaded based on potential electric vehicle (EV) charging penetration rates for single-phase transformers ranging from 15 to 100 kVA. This study found that smaller transformers have a high likelihood of being overloaded and, as the size of those transformers increases, the percentage of overloaded transformers at a given kVA goes to zero beyond 100 kVA. In a high-EV penetration scenario (50% by 2035), overloading likelihood ranges from 100% for 15 kVA transformers to 2.5% for 100 kVA transformers. This is an immense variability and it requires real information about what is happening on transformers of different sizes.

See Dalah, S., Aswani, D., Geraghty, M., Dunckley, J., Impact of Increasing Replacement Transformer Size on the Probability of Transformer Overloads with Increasing EV Adoption, 36th International Electric Vehicle Symposium and Exhibition, June, 2023. Available online at: https://evs36.com/wp-content/uploads/finalpapers/FinalPaper_Dahal_Sachindra.pdf.

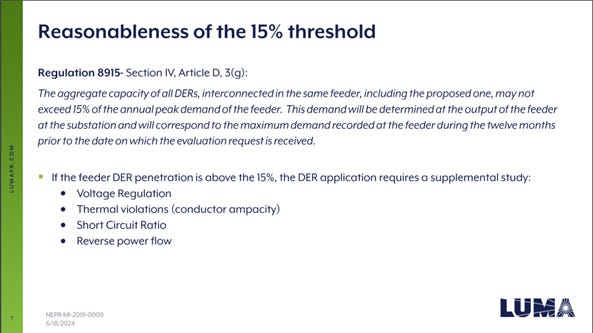

Static interconnection thresholds are unnecessarily constraining renewable integration (such as, DER penetration on a feeder cannot exceed 15% of annual peak demand of the feeder, and all applications above that threshold will require a new utility study for voltage regulation, thermal violations (conductor ampacity), short circuit ratio, and reverse power flow).

In Puerto Rico, LUMA Energy's reliance on a conservative 15% static threshold for feeder saturation is constraining renewable integration despite evidence supporting higher limits. The current debate over increasing this to 30% reveals that technical capability isn't the barrier - regulatory frameworks and cost recovery mechanisms are. As confirmed in the October 2024 regulatory filing, LUMA acknowledges no technical impediments to the higher threshold but resists implementation due to concerns about cost recovery for supplemental studies. This situation demonstrates how real-time monitoring and data-driven approaches could help resolve such regulatory deadlocks by providing actual operational evidence to support higher hosting capacities, while also highlighting the need for updated regulatory frameworks that better align utility incentives with grid modernization goals.

Dynamic Load Management through Visibility to Utility Equipment is a Huge Opportunity for Utilities to Tackle Electrification. An EV Bus Depot interconnection story from Australia is a success we can repeat on any utility system in the US with the right equipment and vision. Through data-driven infrastructure management for an EV bus depot, Endeavour Energy demonstrated how advanced monitoring can transform infrastructure planning. The utility deployed Edge Zero's monitoring solution to optimize resource utilization, effectively managing new electrical loads from the EV bus depot while maximizing existing infrastructure.

This smart approach led to dramatic cost savings, reducing capital expenditures from $6.5 million to $2.5 million AUD by avoiding unnecessary upgrades. The technical details reveal the sophistication of this solution. Endeavour installed approximately 20 individual load monitoring devices across distribution transformers along feeder PH1267, using Edge Zero's real time sensor technology to aggregate and analyze the data.

The monitoring revealed that the existing feeder had sufficient capacity to support 66 operational electric buses if managed dynamically - a significant improvement over traditional static planning approaches that would have required a dedicated feeder after just 28 buses.

The project proved the value of real-time monitoring for asset optimization. By identifying that the bus depot could draw up to 2.45 MW at night and early morning versus only 0.57 MW during peak hours, Endeavour could safely support electrification without major upgrades. This implementation improved both grid stability and load factors while providing a scalable model for future fleet electrification projects.

The success has broader implications - Edge Zero notes that on feeders with lower diversity factors, the impact of dynamic load management could be even more significant.

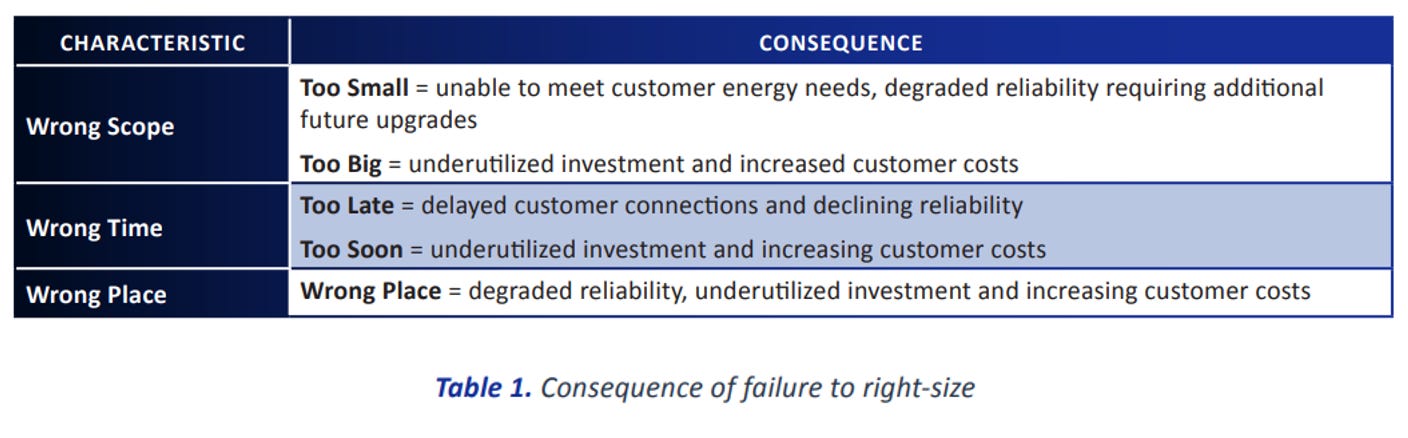

Distribution planning must shift from reactive to proactive approaches. Earlier this year in Dallas, EPRI and DOE partnered to host 17 electric distribution companies to discuss "right-sizing" the grid for decarbonization. The key insight was that utilities can no longer wait for load growth to appear before planning upgrades. EPRI’s CEO recently noted regarding this effort, "We not only have to right size the grid but build the grid in advance of the anticipated electricity demand growth which we haven't seen in decades."

EPRI 2024 White Paper : Designing Distribution Systems to Enable Deep Decarbonization - https://restservice.epri.com/publicdownload/000000003002030782/0/Product Traditional 15-minute AMI data proves insufficient for modern grid dynamics and AMI is not the answer to understanding real-time power quality considerations for a specific piece of the utility system itself. AMI's limitations as a grid management tool stem from several factors. First, AMI's primary design purpose was billing and basic consumption monitoring, not real-time grid operations. While AMI is valuable for time-of-use pricing and billing accuracy, it cannot address critical grid edge challenges. Monitoring solutions must be positioned in different parts of the network of the utility operator itself: while AMI manages customer usage relationships with utility equipment, grid sensors manage infrastructure health and operations of the equipment itself. Further, AMI deployment faces significant equity challenges - consumers without technology eligible for AMI-enabled programs can face regressive costs, as they often get AMI last but bear the deployment costs first. This distinction becomes particularly important for utilities managing growing DER penetration and EV adoption, where millisecond-level visibility of power quality and transformer health is critical for grid stability and asset management, and investing in monitoring their system in these areas is a cheaper proposition than replacing every meter. “ [R]esults from a range of studies suggest that many of the promised benefits of AMI have yet to be delivered even after a decade of implementation. For instance, a 2022 analysis from the Mission:data Coalition found that 97% of smart meters fail to provide promised customer benefits, and a 2020 report from the American Council for an Energy Efficient Economy (ACEEE) found that utilities “are largely missing the opportunity to utilize AMI data to improve their energy efficiency and demand response offerings, in part due to regulatory, administrative, and technological barriers.” Unsurprisingly, a handful of states have blocked multimillion-dollar smart meter deployments over the past few years, and there is growing regulatory scrutiny of the benefits that AMI deployments actually provide.” Utility Dive Article: https://www.utilitydive.com/spons/falling-out-of-love-with-ami-why-we-need-a-new-approach-to-smart-metering/642212/

End-of-the-line transformers are far smaller in the US for residential and small customers. But these transformers are also where routine electrification rates are increasing and loads added are becoming more variable and significant. Grid sensors provide utilities critical visibility they previously lacked below the substation level – all the way down to the 10kVa transformer.

This real-time data integrates with VEC's distributed energy resource management system (DERMS) to manage the increasing penetration of rooftop solar (currently over 30 MW) and electric vehicles.

Unlike AMI's 15-minute billing intervals tied to individual users, these sensors provide continuous monitoring that supports immediate operational decisions for the infrastructure tying together multiple users, from customer program optimization to enhanced distribution planning and even wildfire prevention. For VEC, which serves 34,000 rural members, this visibility is crucial for maintaining reliability while meeting Vermont's new mandate for 100% renewable electricity generation. The system provides what Cyril Brunner, VEC's Innovation and Technology Leader, calls "a complete picture of our distribution grid," essential for managing DER integration while minimizing infrastructure impacts during the energy transition.

Real-Time Visibility to Utility Grid Edge Infrastructure is not an unrecognized need, but it is underrecognized. Leading utilities are deploying advanced monitoring solutions to catch up the industry as a whole to the importance of this innovation.

Vermont Electric Cooperative prevented outages within first month of deployment of Edge Zero low voltage sensors and identified and replaced three faulty transformers.

Dominion Energy, PG&E, Duke, and PPL are running pilot programs on high and low voltage equipment sensing as well.

Southern Company/Georgia Power has deployed Energy 4.0 sensors to monitor their 1100 + high voltage transformer fleet in Georgia. These real-time sensors are doing 24x7 monitoring, allowing Southern Company to implement a condition-based maintenance program and extend maintenance cycles by 200%.

Attention to the low-voltage grid has enabled Australian utilities to better handle and strategize around the growing penetration of rooftop and distributed DERs, and EVs. Learn more about low-voltage grid enhancing technology here:

The US Regulatory Evolution

The regulatory landscape is adapting to support innovation:

Regulators increasingly recognize data-driven investments as prudent

Cost recovery mechanisms are evolving for grid edge investments (Connecticut’s utilization of a new program design sandbox gets away from “pilot hell”, Michigan’s regulators want pilots to be expedited outside of rate case proceedings in their own process).

The Path Forward

Success in grid edge innovation requires:

Moving from static to dynamic approaches for understand the utility grid itself

Implementing sophisticated data analytics

Developing new regulatory frameworks

Sharing knowledge across utilities on which tools that are cheaper and faster (and less customer-invasive) than AMI 2.0 are available asap to help their understand their system and how to leverage DERs instead of blocking their adoption in a vacuum of missing information about their infrastructure, particularly low voltage transformers and secondary feeder